Stonewell Bookkeeping for Dummies

Wiki Article

Rumored Buzz on Stonewell Bookkeeping

Table of ContentsThe Best Guide To Stonewell BookkeepingThe 5-Second Trick For Stonewell BookkeepingThe Facts About Stonewell Bookkeeping UncoveredRumored Buzz on Stonewell BookkeepingWhat Does Stonewell Bookkeeping Mean?

Rather of going through a declaring cupboard of various files, billings, and receipts, you can offer in-depth documents to your accounting professional. After utilizing your accountancy to file your taxes, the Internal revenue service may pick to do an audit.

That funding can come in the form of owner's equity, gives, service loans, and investors. Capitalists require to have a great idea of your business prior to spending.

Stonewell Bookkeeping - The Facts

This is not planned as legal advice; for additional information, please visit this site..

We addressed, "well, in order to know how much you need to be paying, we require to recognize just how much you're making. What is your internet earnings? "Well, I have $179,000 in my account, so I think my web income (revenues much less expenditures) is $18K".

The Only Guide for Stonewell Bookkeeping

While it could be that they have $18K in the account (and also that might not be real), your balance in the bank does not always identify your earnings. If somebody obtained a grant or a lending, those funds are not taken into consideration income. And they would certainly not infiltrate your revenue statement in establishing your profits.

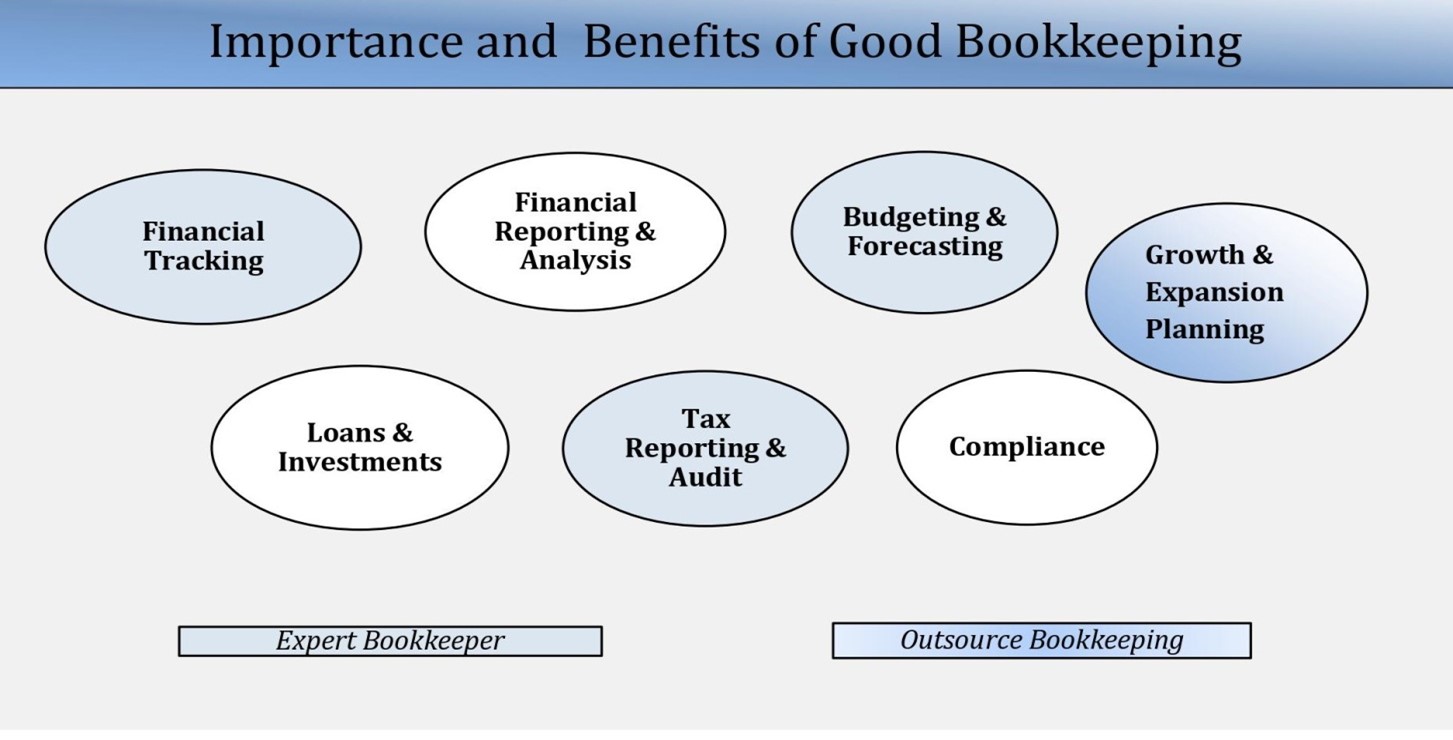

While it could be that they have $18K in the account (and also that might not be real), your balance in the bank does not always identify your earnings. If somebody obtained a grant or a lending, those funds are not taken into consideration income. And they would certainly not infiltrate your revenue statement in establishing your profits.Several things that you assume are expenses and deductions remain in fact neither. An appropriate set of publications, and an outsourced bookkeeper that can effectively categorize those purchases, will certainly aid you identify what your service is actually making. Bookkeeping is the process of recording, identifying, and organizing a business's monetary transactions and tax obligation filings.

An effective organization calls for aid from specialists. With sensible objectives and a qualified accountant, you can quickly attend to difficulties and keep those worries at bay. We commit our power to ensuring you have a solid financial structure for development.

The 4-Minute Rule for Stonewell Bookkeeping

Exact bookkeeping is the foundation of great financial monitoring in any type of business. With excellent bookkeeping, organizations can make much better decisions due to the fact that clear monetary records use important information that can direct strategy and improve profits.Precise economic declarations build depend on with lending institutions and investors, enhancing your possibilities of obtaining the resources you need to grow., services need to regularly resolve their accounts.

An accountant will cross bank statements with internal documents at the very least as soon as a month to locate errors or variances. Called financial institution reconciliation, this process guarantees that the financial documents of the firm suit those of the bank.

They keep track of present payroll information, subtract taxes, and figure pay ranges. Accountants produce fundamental financial records, consisting of: Revenue and Loss Statements Reveals earnings, costs, and web profit. Annual report Provides possessions, liabilities, and equity. Capital Declarations Tracks cash activity in and out of the service (https://issuu.com/hirestonewell). These records aid entrepreneur comprehend their monetary placement and make educated choices.

Our Stonewell Bookkeeping Diaries

While this is economical, it can be time-consuming and vulnerable to errors. Devices like copyright, Xero, and FreshBooks enable company proprietors to automate bookkeeping jobs. These programs assist with invoicing, bank settlement, and financial coverage.

Report this wiki page